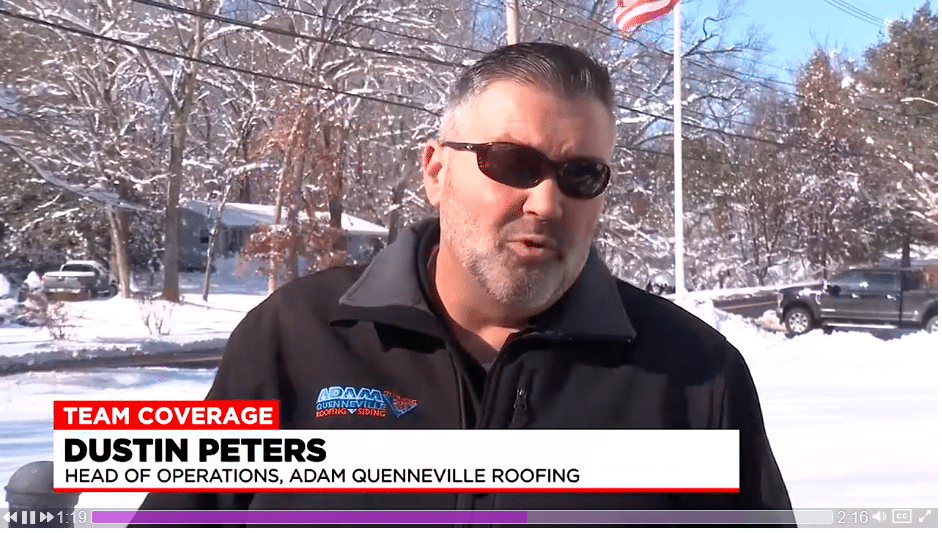

In advance of Tuesday's storm, WGGB's Dan Brown talked to local experts, including AQRS Head…

How To File An Insurance Claim For Roof Damage

When bad things happen to good roofs!

We all take storm warnings more seriously these days. Climate change and active storm seasons are wreaking havoc everywhere we look. Bad things happen to good roofs, and as the homeowner it’s your duty to know what to do if your roof gets damaged. A severe storm can be horrifying and replacing what Mother Nature has destroyed can be troubling. Recovery starts by assessing and documenting the damage, filing a timely claim with your insurance company, and working with a professional roofing company like Adam Quenneville Roofing & Siding to put all the pieces back together again. Here’s a way to get started if the unthinkable happens to you.

PUT YOUR SAFETY FIRST

Wait until the storm has passed and it’s safe to go outdoors before you check your roof. Never go outdoors when there is still active lightning or dangerous conditions. Wear shoes to protect your feet from nails or sharp objects that may have fallen to the ground during the storm. Watch for falling branches, trees and debris still flying in the wind. Ladders and rooftops can be slippery when wet, so stay at ground level and leave the ladders and rooftop inspection to a professional roofer. If your roof is partially or completely gone or collapsed, leave the premises immediately and find somewhere safe to go until a roofer can secure the damage.

DOCUMENT ROOF DAMAGE IMMEDIATELY

Document everything with photos, videos, and keep accurate records. Save all receipts. You may even want to take photos of your roof today so when damage occurs, you have photos of what your roof looked like before the storm. Don’t wait for tomorrow or the next day. Leaks from roof damage can cause more problems indoors. Immediately after the storm has passed, use your cellphone to take photos or videos of the damage you can safely capture or record from the ground. Whether it was wind damage, hail damage, a natural disaster, or a major storm, it’s important to immediately document the damages left behind.

INSPECT YOUR ATTIC

If possible, go to your attic with a bright flashlight. Check for leaks in the attic ceiling or around the chimney or walls, and search for puddles of water on the floor or insulation. Look for water dripping from the rafters or wet spots on storage boxes or attic items. If you notice any leaks in the attic, put buckets under the leaks and empty them as they fill up. Use tarps to cover areas and items near the leaks. If your attic is unfinished or offers only a crawl space, wait for help from a professional roofer.

CHECK YOUR INSURANCE POLICY

It’s good to keep the most current copy of your insurance policy where you can find it in an emergency. And it’s good to refresh your memory at times on what is covered and what is not. For example, did you exclude wind and hail damage to save money? With more severe storms taking place now than ever, you may want to review and upgrade your coverage when it comes to storm damage. Look for the ‘dwelling coverage’ section of your homeowners insurance policy to see the coverage you have. This should explain what types of roof damage are covered under your policy. Coverage will depend on the terms of the policy and the reason your roof needs to be repaired or replaced. Usually, your policy will cover sudden or accidental problems that are caused by wind, fire, hail, or heavy snow. Your insurance policy should also include information about your deductible, the amount you must pay for repairs before your insurance company covers the rest. If you can’t find your copy of the policy, your insurance representative can assist you.

CONTACT YOUR INSURANCE COMPANY

Call your insurance company as soon as you can to let them know there is damage to your roof. Explain the extent of the damage from what you can tell, and what caused it to happen. Confirm with your insurance company that the damage is covered and check on your deductible. Find out how long you have to file the actual claim. Your insurance company will guide you on how to file a claim and it will provide you with the appropriate paperwork you need to start the claim process. If you must stay in a hotel because your home is not safe, your insurance company should reimburse you for the stay. Your insurance company may also send their own adjuster to assess your damage. That adjuster works with the insurance company on the amount of damage and the cost of repairs. If your insurance company denies your claim or pays less that what the cost will be, you have the right to appeal.

CALL A PROFESSIONAL ROOFING CONTRACTOR

If possible, hold off on roof repairs if you can until the insurance company approves your claim. Some insurance companies have a list of roofing contractors that you must use. Some roofers will work directly with your insurance company. If your roof needs immediate attention because it’s leaking or severely damaged, a roofing contractor may choose to cover the damaged roof with tarps and secure the damaged area until it can be repaired or replaced. If there are just a few shingles missing or damaged, your actions may not be as urgent. Never hire a contractor who is not licensed. Only choose a roofing contractor who has experience with insurance claims.

STATUTE OF LIMITATION ON CLAIMS

There may be a statute of limitations on when you must report the damage and file a claim. The estimate you get on damages will look at what you had to begin with, and not what you want you want for your future roof. The insurance adjuster cannot determine the cost of a roof, but your roofing contractor has the knowledge and expertise to give you an accurate estimate of cost. Some homeowners hire a public adjuster to work with them or if necessary to appeal. Ask about roofing materials that may qualify for insurance discounts.

ASSESS FOR FUTURE PROBLEMS

We all know that wind can rip the shingles off the house, destroy flashings and damage underlayment. Those damages are usually obvious. Your roofing contractor can assess the damages that may not be so obvious to the eye but can cause future problems. For example, small leaks can cause interior mold problems in the future. Pits and dings from large hail can cause shingles to eventually crack and cause damage underneath. Weak spots may mean rotting problems. A roofing contractor knows what to look for and it’s better to be safe than sorry down the road.

INSURANCE COVERAGE CHANGES

The increase in damaging storms in the past few years has prompted some insurance companies to protect themselves by implementing different levels of coverage for things like wind and hail damage. This may include cash value coverage if your roof is old and has a depreciated value. That means you would have to cover what the insurance company did not. If you don’t have flood insurance or earthquake insurance, your insurance will not cover roof damage caused by these disasters.

PREVENTIVE MAINTENANCE

Homeowners are responsible for maintaining their properties and that includes the roof. Your insurance policy will rarely cover damages caused by lack of maintenance, wear-and-tear, or old dried out shingles. Your roofing contractor can help you maintain your roof over time by performing regular roof tune-ups. The roofer can inspect your roof and replace missing or damaged shingles and flashings. They will look for leaks, cracked or curled shingles, mold, rot, moisture seepage and other issues that could escalate to future problems. They can offer solutions to extend the life of your roof.

CALL ADAM QUENNEVILLE ROOFING & SIDING

For regular maintenance on your roof, roof tune-ups, free estimates, and professional roofing services, contact Adam Quenneville Roofing and Siding. An honored member of the Better Business Bureau for several years, Adam Quenneville Roofing and Siding will work directly with you and/or your insurance company to repair or replace your roof. Adam Quenneville offers peace of mind for you, relief for your damaged roof, emergency services, and 100% financing when you need it. It’s a name you can trust when bad things happen to good roofs.

Blog by Deborah O’Neill, Allen Media, Inc.